The Liquid Network is a Bitcoin layer-2 solution that bolsters the network effects of Bitcoin by providing a secure platform for digital asset issuance, bringing new financial instruments and distributed trust models that investors and institutions can leverage.

Liquid does not replace or compete with Bitcoin. Both protocols mutually benefit each other, with Bitcoin providing the underlying security and value for the BTC stored in the Federation’s multisig wallet and with Liquid as a complementary financial layer in a hyperbitcoinized future, onboarding modern financial instruments like securities and bonds.

Elements, the open-source sidechain-capable platform that Liquid is built on, has also been a testbed for technology upgrades to Bitcoin, including OP_CSV and Segregated Witness (SegWit). Simplicity, a sophisticated smart contracting language currently in development, will be released soon on Elements and Liquid, and could potentially be another technology upgrade to Bitcoin.

Due to the complexity of Liquid’s security and governance model, misconceptions have formed over the years, which don’t accurately reflect how its federated model operates under the hood.

We’ve put together the following document in an effort to help the community better understand Liquid’s design philosophy and the careful thought that went into those decisions.

Liquid Is Decentralized But Not Fully Permissionless

Liquid is designed to meet the rigorous standards of modern global financial markets while maintaining decentralization through distributed architecture and governance. While it's not fully permissionless like Bitcoin, Liquid is fault-tolerant, censorship-resistant, and has different trade-offs than other second layers like Lightning.

The Liquid Federation

Liquid has a distributed governance model of more than 60 members around the world, who comprise three boards responsible for varying tasks.

- Membership Board: develops the criteria and recommendations for adding new members or removing current ones.

- Oversight Board: recommends internal rules for membership structure and management, and oversees the network’s status.

- Technology Board: works with Blockstream to develop a technical roadmap based on the needs of Liquid Network members.

Members are leading exchanges, digital asset managers, wallet providers, and other Bitcoin-focused companies. It’s important to understand that no single member controls the network.

Becoming a Member

Any company may apply to become a Federation member, a decision discussed and voted on by the Membership Board. Adding a new member requires a minimum of 3-of-5 to vote in favor of adding the new member to the Federation. When it comes to the criteria for approving a new company to become a member, there are guidelines that the Membership Board checks.

For new membership, the applicant is assessed by the following guidelines:

- A clear objective to join the Liquid Network with a demonstrable use case and plan to be an active participant

- Applicant agrees to the principles set forth in the Liquid Federation Member Charter

- Technically capable of supporting the Liquid Network

- Does not diminish the reputation of the Liquid Network

- Operating a legal entity in a jurisdiction other than a Restricted Jurisdiction

- Provides a copy of company registration or business license

The easiest way to apply to become a Federation member is to send an email to business@liquid.net and introduce your company and explain what you are working on.

As a member, enterprises gain the ability to peg-out of L-BTC back to BTC through the inclusion of a Peg-Out Authorization Key (PAK), run for election to become a member of one or more of the Liquid Federation boards, and gain access to internal resources, communications, and participate in discussions on future network upgrades.

Special Federation Roles: Functionaries and Blockstream

The network is secured by an equally geographically distributed but smaller group of Federation members, called functionaries. There are currently 15 independent functionary operators, which we’ll explore further in the next section.

Blockstream also plays an important role as the technology provider of the Liquid Network, since it develops the software that Liquid members will eventually evaluate and vote on whether to adopt—through membership on the Technology Board.

Additionally, users of Liquid are always able to self-verify activity (e.g., L-BTC is backed by BTC 1:1, peg activity, transactions, new blocks) on the network by running a Liquid full node and can contribute to the open-source Elements project, which Liquid is built on.

Liquid Is Secure

Liquid blocks are generated by a geographically and geopolitically-distributed federation of 15 signers (i.e., functionaries) running hardware security modules (HSMs). The round-robin block proposing, combined with the consensus mechanism that drives Liquid, requires 2/3rds + 1 (or 11-of-15) functionaries to approve.

This means several functionaries can be offline, and the network will still create new blocks to progress the chain, bringing a higher degree of resilience. With the activation of Dynamic Federations (DynaFed) last year, Liquid functionaries will be able to join or leave without affecting network operations, enabling even greater resiliency.

Liquid could also benefit from a new signature scheme called ROAST, which would guarantee that a quorum of functionaries could always sign even in the presence of disruptive signers and theoretically scale the number of functionaries to hundreds for further decentralization of Liquid’s consensus mechanism.

Funds Are Safe

Bitcoin / Liquid Bitcoin

The BTC that backs the L-BTC on the Liquid Network is stored on the Bitcoin blockchain in a multisignature wallet that requires 11-of-15 functionaries to sign, using keys stored on their external HSMs. In addition, each functionary’s HSM can only authorize peg-outs to addresses derived from one of the PAK keys.

Stealing from the Federation's multisig wallet would require compromising 11 separate HSM devices around the world in person while remaining undetected or for 11-of-15 functionary operators to be dishonest and collude.

This implausible Ocean's Eleven sequel would be no easy undertaking. The keys never leave the HSMs, so remote extraction is improbable. In-person extraction is no easy task either because of the geographic separation of the devices. In the latest version of each module (HSM2), the hardware is custom-built using a modular architecture and contains a fail-safe mechanism that can be triggered when an unauthorized opening is detected, automatically erasing that functionary's keys and effectively locking down the device. The HSM2 with these additional security features is set to be test ready by the end of the year.

Even if an attacker could somehow commandeer all 15 HSMs, theft would still be improbable, as the HSMs firmware will only sign transactions to pre-approved addresses on the PAK list.

Digital Assets

Other digital assets on Liquid, like stablecoins, voucher tokens, and NFTs, are subject to the same underlying security and consensus model. Regulated security tokens like the BMN are an exception because they have additional legal and contractual protections for qualified investors.

Liquid Has Strong Censorship-Resistance

Liquid preserves its resistance to censorship by achieving a certain level of decentralization via a federated trust model.

A system's overall performance in a fully decentralized network is restricted because each member node must validate all data. The goal of a maximally effective blockchain is to maintain the minimum amount of decentralization necessary for censorship resistance. Like Bitcoin, Liquid users can self-custody their assets on the blockchain, with the assurance that no Federation member can block, censor, or reappropriate funds because users don't have to trust any individual entity or node.

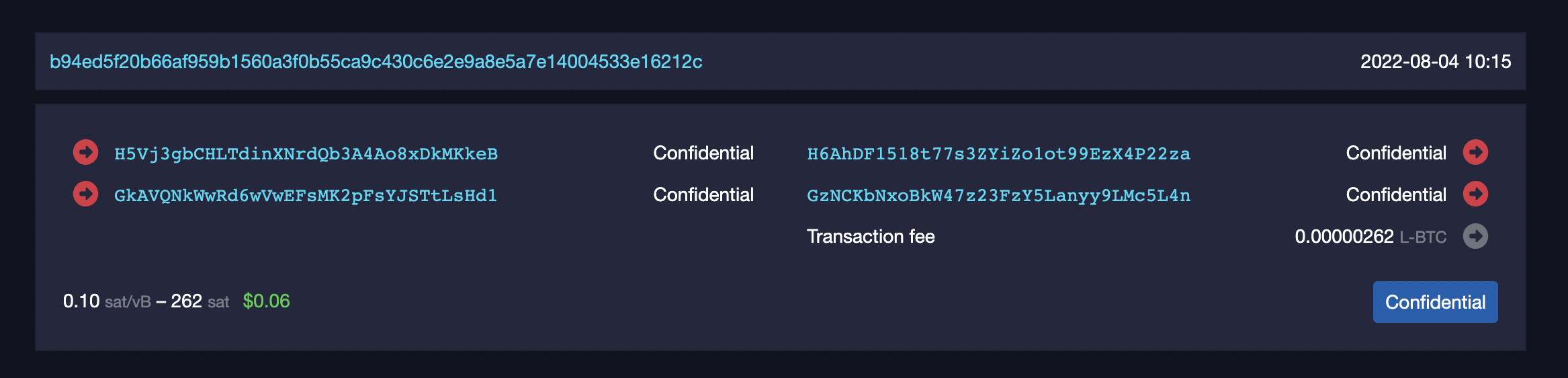

In addition, Liquid's Confidential Transactions blinds transaction amounts and asset types, making distinguishing what on-chain output(s) to censor nearly impossible, unlike other blockchains like Ethereum.

Furthermore, in order to effectively censor an output, one-third of the Liquid functionaries must collude to not include those outputs in new blocks.

The lack of onchain confidentiality on altcoin platforms is a major liability for serious investors and financial institutions, allowing for the possibility of front-running and increasing the risk of liquidation. For example, when a liquidation price is public on-chain, like in the case of Celsius, bad actors know precisely how much to manipulate the price to force liquidations.

KYC Is Not an Embedded Feature in Liquid

Anyone can peg bitcoin into Liquid using Bitcoin Core and Elements full nodes running on their local machines. KYC is not built into any part of the software. Depending on the service provider building on Liquid, KYC information may be requested for the purposes of complying with the local regulatory requirements the company is operating at.

For the security reasons mentioned earlier, Liquid members (on the PAK list) and the 15 functionaries are currently the only entities that are authorized to perform peg-outs on the network. Depending on the platform, they may request that you submit KYC information to receive BTC from a peg-out, but on a protocol level, KYC is not an embedded feature.

Security tokens on Liquid, such as the BMN or the SSWP, an equity issuance from SideSwap, will also require some level of KYC to satisfy international security law to ensure token holders have investor rights and proper protections.

Other than the securities above, users can trade Liquid assets like stablecoins, vouchers, or NFTs freely and anonymously.

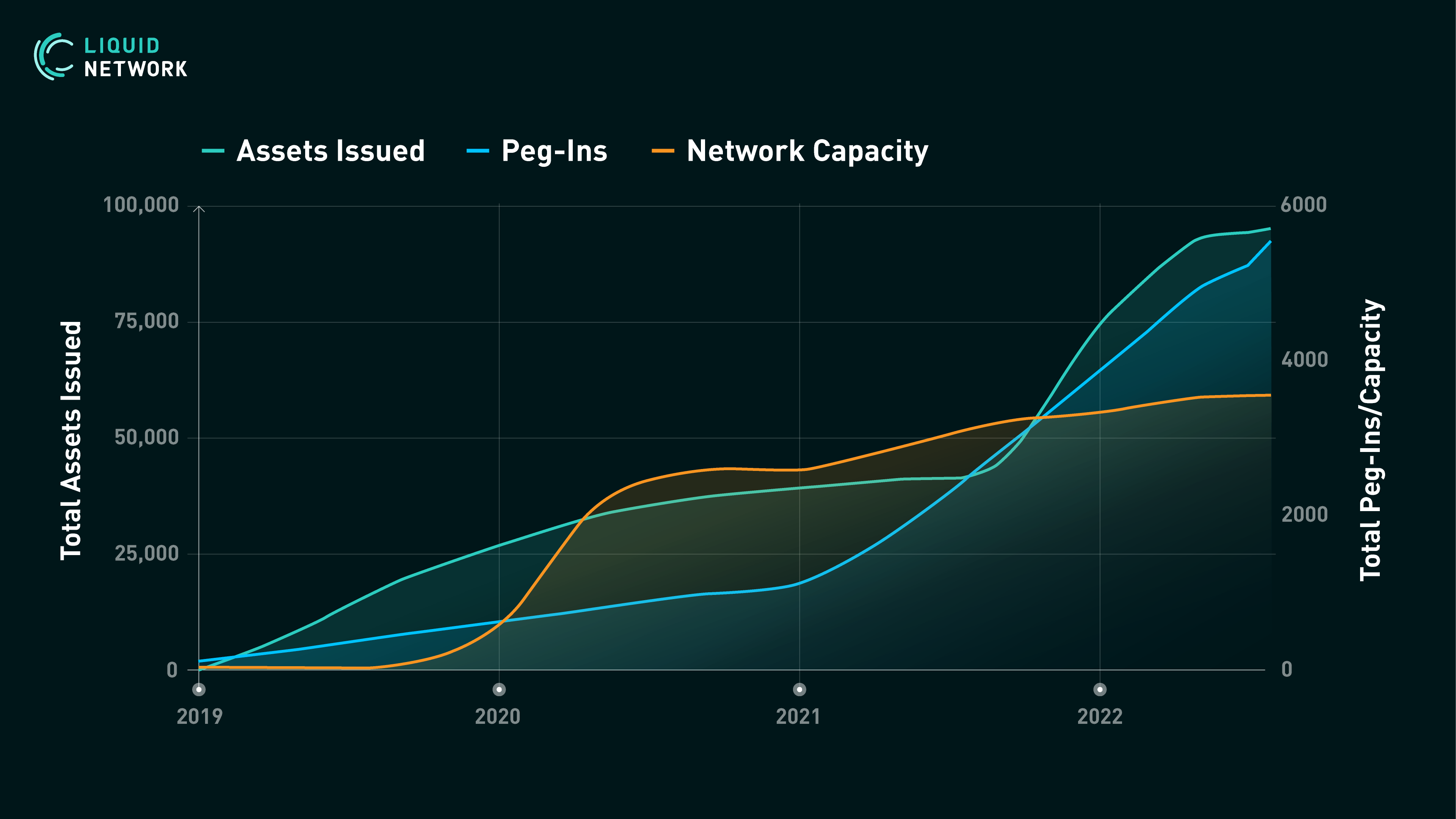

Liquid Adoption Is Increasing

There's been a steady rise in Liquid use, and the network has played a key role in the larger Bitcoin adoption and development story since its launch in late 2018. Whether optimizing bitcoin arbitrage between exchanges or bringing new capabilities like asset issuance and faster settlement to the space, we believe the Bitcoin ecosystem is stronger and more competitive because of Liquid.

Network capacity or the total number of bitcoin bridged to Liquid has reached all-time highs in recent months to just over 3,500 BTC. Peg-in volume over the past year has increased by 560% compared to 2019-2021, and the total number of assets issued has more than doubled year over year.

We expect continued growth as the macroeconomic environment accelerates hyperbitcoinization and more Bitcoin transaction volume shifts onto Liquid to save on fees and to access the expanding DeFi ecosystem and financial products available on the network.

The much-anticipated El Salvador Bitcoin Bond, which is expected to be tokenized on Liquid, could likely be the catalyst for such an adoption.

Join the Liquid Community, and Start Building on L2

Join the Liquid Community Telegram channel or the new Liquid subreddit to access builders, investors, and learning material to discover firsthand how to use the Liquid Network. If you're a developer, join the more technically-minded Dev Telegram and start building today by reading Sonny's introduction to developing on Liquid along with our guide here.

If you represent a business and would like to explore how your business can leverage Liquid, send us an email at business@liquid.net.