Mifiel, a legal company specializing in digital signatures for financial institutions, has announced a digitized promissory note product issued on the Liquid Network to facilitate debt financing between Mexican lenders and global investment banks. The promissory notes are used in collateralized financing operations by non-banking financial companies in structured debt vehicles. Of the estimated 69,000 promissory notes created worth ~$212 million, the company has issued ~$43 million on Liquid thus far, with potentially more worth billions over the next few years.

Digitization (often referred to as tokenization) offers issuers cost-efficient access to global liquidity with less friction and investors greater control of their financial assets with peer-to-peer trading and self-custody.

At the time of publication, Mifiel has issued more than 2,000 promissory notes on Liquid, worth an average of $23,000 per note.

Tomás Alvarez, CEO and Cofounder of Mifiel discusses using the Liquid Network as issuance technology for promissory notes in Mexico.

Role of Promissory Notes

Physical promissory notes are considered high-value financial assets in emerging economies like Mexico due to their strong legal protections for lenders during debt collection when compared to alternatives. Due to this legal benefit, most of the credit issued by non-banks in Mexico (B2B and B2C) is in the form of promissory notes.

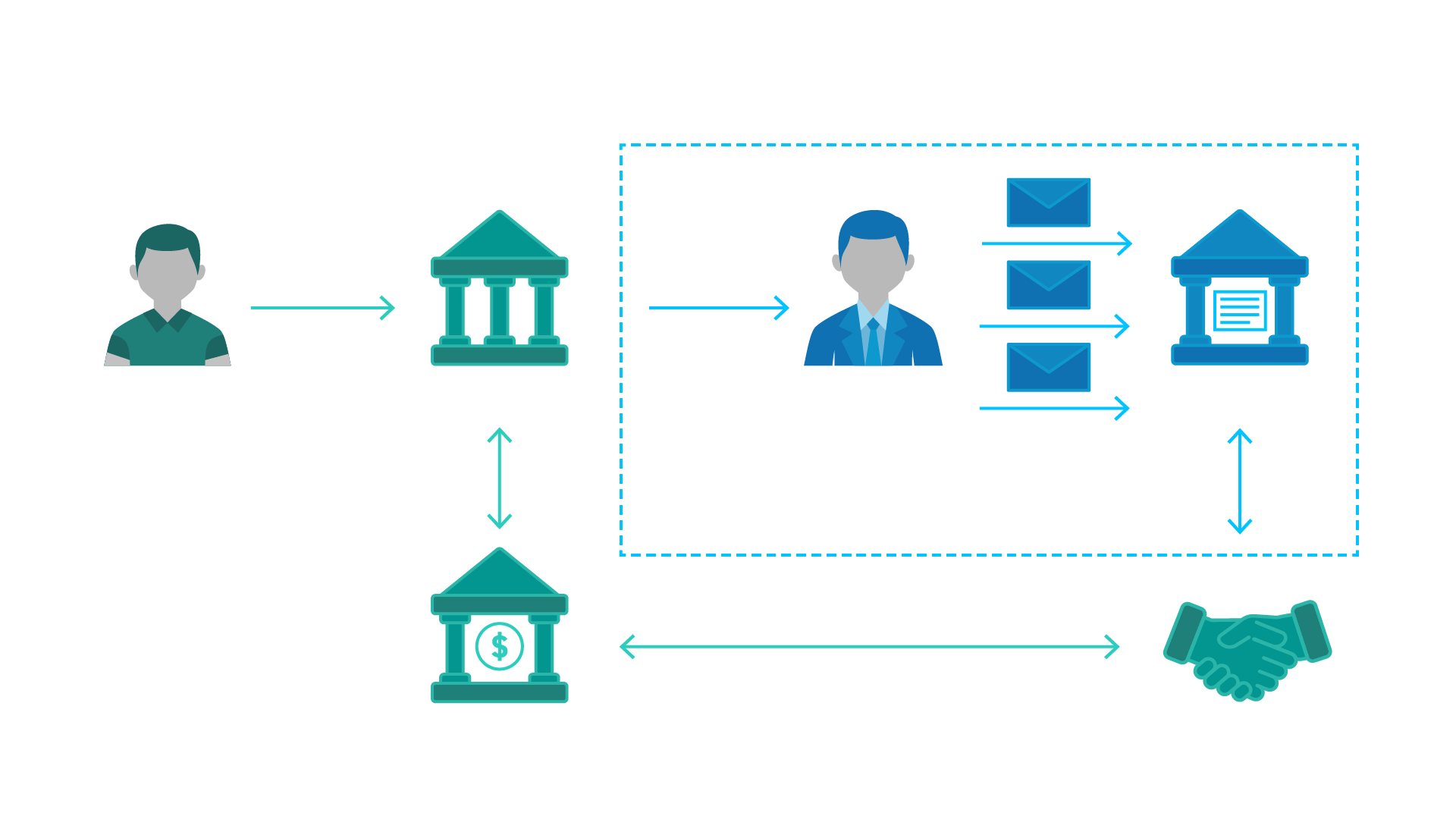

When a financial institution is looking for funding from other lenders or capital markets, it is typical for them to post the promissory notes signed by their debtors as collateral. The financial institution (FI) endorses the promissory note to a bank trust, and the lender transfers the money to the FI. The promissory notes are the collateral for the loans.

Current Complexity and Challenge of Digitization

A structured debt operation involves multiple parties. Besides the FI that posts the promissory notes and the lender who lends the money to the FI, there is also a bank that incorporates the trust, a loan servicer, a backup servicer, and a custodian of the promissory notes. When lending is facilitated through capital markets, even more parties are required.

Moving and storing the physical promissory note is complex due to the sheer number of notes involved; having a few thousand in a single structured debt operation is standard. Verifying them is also quite tedious since the promissory notes must be physical and counted manually.

Digitizing promissory notes has historically been challenging because there is no fail-safe way to guarantee that only one copy of the promissory note is being endorsed and not rehypothecated to multiple lenders. One approach used in some countries is to leverage a centralized electronic repository and legally mandate that all promissory notes and any transfers of these instruments be registered in it. However, most jurisdictions have opted not to implement such a centralized repository for electronic promissory notes due to legal concerns and the systemic risk it creates.

Liquid as a Solution

Liquid solves the digitization dilemma by verifying each promissory note and its ownership on the blockchain. Each promissory note cryptographically links to a unique digital note or 'token' on Liquid, allowing the borrower to endorse to a lender and transfer the token to a new owner. The token functions similarly to how a CUSIP or ISIN identifies a specific financial asset but with greater verifiability, creating a new financial use case for NFTs in the form of digital CUSIP notes. Even if standard identifiers (i.e., borrower, principal, coupon, and maturity) are the same across promissory notes, each party can verify and authenticate the correct one using the token.

As more promissory notes and other financial products move to a digitized standard, issuing on Liquid provides a compliant and secure way for homegrown FIs to diversify and access international lending markets with greater flexibility and freedom of use.

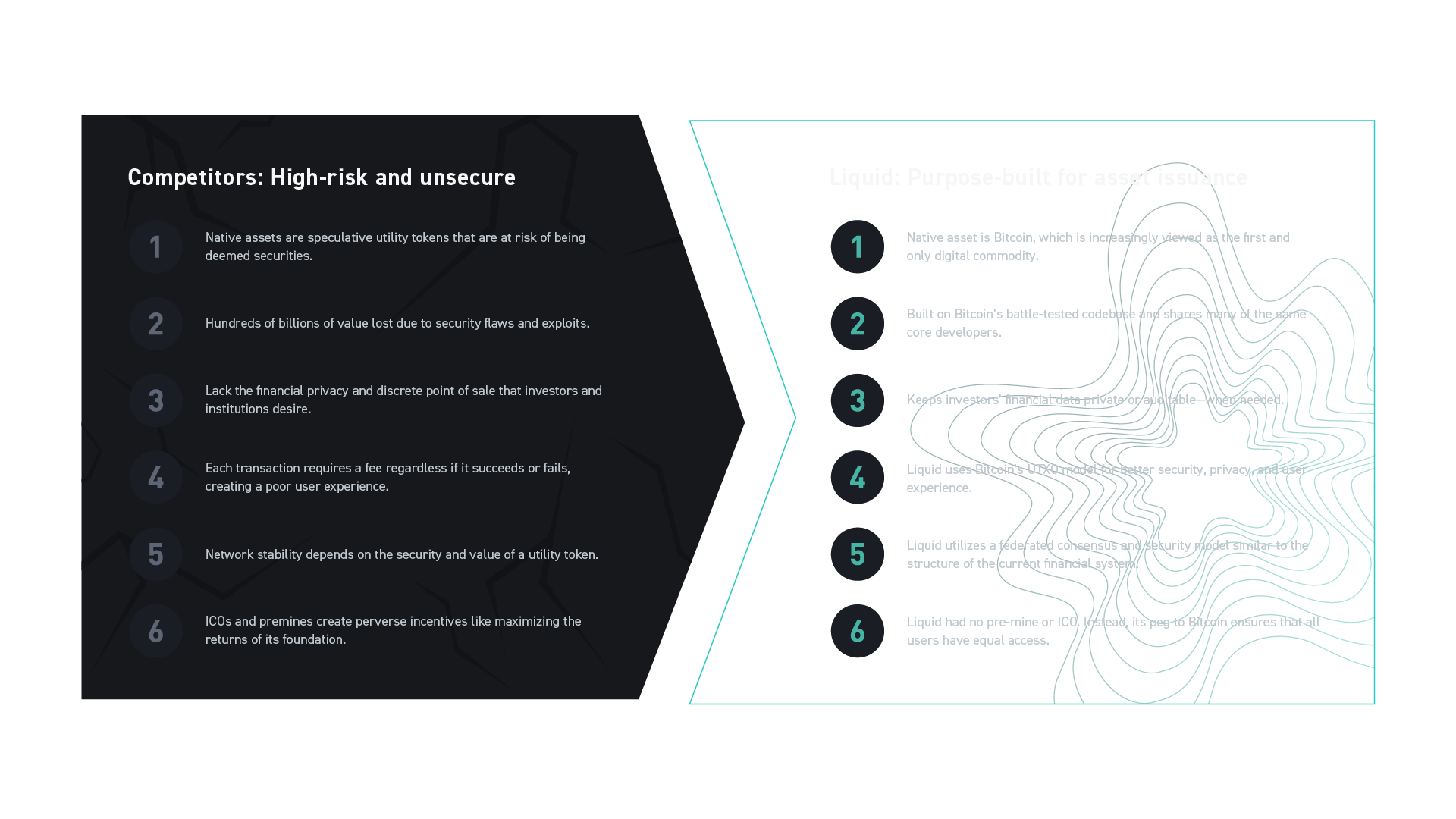

“After originally building on a ColoredCoins protocol, we decided to migrate to a more suitable solution. We evaluated most public blockchains and concluded that Liquid offered the best balance between security, decentralization, regulatory risks and transaction costs,” said Tomás Álvarez Melis, Cofounder at Mifiel.

Overly expressive smart contracting languages lead to security flaws, exploits, and hundreds of millions of value hacked yearly. Liquid's technical team is led by Blockstream, one of the leading Bitcoin infrastructure firms, focusing on security-first principles. It deploys a simple, low-level programming language based on Bitcoin Script on Liquid and has shared many of the same Bitcoin Core developers.

For complex digital assets that require more programmability, there is the Blockstream AMP application, allotting financial institutions a high level of granularity when defining the transfer and ownership of tokens and creating a value-add for the life cycle management of digital securities.

Capital Markets on Liquid

You can learn more about Mifiel and its plans for issuing debt instruments on Liquid by connecting directly with Tomás Álvarez on the Build On L2 community. The Capital Markets page on the platform is also an excellent go-to resource for those interested in discussing financial products and markets on Liquid.

If you are interested in asset issuance or learning how to integrate Liquid into your business model, email us at business@liquid.net.