Financial assets like equity or corporate bonds managed electronically have posed a unique challenge for financial markets due to the difficulty in tracking ownership. The risk of an asset being simultaneously claimed by multiple owners, a process called rehypothecation, creates systemic risks for these markets, the industry and any investor.

For a very long time, authorities have grappled with these issues and as a result, highly centralized, tightly regulated, and regularly audited depositories and clearing houses were established. These organizations are given the authority to define the truth, meticulously documenting who owns what financial asset at any given point in time.

The transaction process begins when a buy or sell order for a stock, bond, or similar asset is placed on an exchange. Once a match is found for the order, the transaction details are sent to a clearing house. This organization facilitates the transaction, ensuring its completion even in cases where the counterparties might not trust each other. For providing this service, the clearing house receives a fee.

The transaction information is subsequently sent to a Central Securities Depository (CSD). The CSD performs detailed reconciliations to ensure that the ownership of each financial asset is accurately recorded in a registry.

Furthermore, members of the exchanges, clearing houses, and depositories are responsible for maintaining internal controls. These controls track the ownership of each asset among their respective customers, contributing to the overall integrity of the financial system. Despite this, the entire system is error prone.

A secure blockchain with adequate spam protection and more can substantially improve this current system. It can facilitate more efficient pairings between capital-seeking companies and prospective investors than what is currently achievable.

This is the value proposition of a blockchain in the financial markets, enabling ownership tracking, management of the full lifecycle of financial assets, settlement without the need of expensive, complex structures and companies or regulations and laws that frequently need trust.

Why Blockchain is Not Enough

The former section explains why blockchains can make financial markets more efficient, but in my opinion, that is not enough to justify a massive shift from the current legacy system to blockchains. We’re talking about many trillions of dollars in asset value.

The incentives must come directly from the issuers, investors, market makers, exchanges, CSDs, clearing houses, etc.

Issuers will only be willing to adopt blockchains if they see a substantial investor presence, and conversely, investors will only join if there are attractive assets to invest in. Other potential players will likely stay away, too, if the platform lacks assets and activity. This presents a classic chicken-and-egg problem: developing an attractive market requires both issuers and investors, but each group is waiting for the other to make the first move.

For issuers to shift to blockchains at a massive scale, adequate liquidity on blockchain systems needs to be available. Currently, that is not the case, and wherever that happens a bit, it's frequently due to scammy tokenomics whereby the issuance of a token has enabled a “pay to play” dynamic. It’s still to be seen if regulators will allow tokenomics to be the main business driver of the industry, but even still, with that, the liquidity is just not enough. What good is it to issue a bond cheaply if no one is able to buy it?

The incentives don’t align unless the specific issuance is unattainable or excessively costly within traditional finance. In other words, there could be situations where an issuance within the conventional financial framework presents a problem that a blockchain can address. I learned that is indeed the case with the issuance of promissory notes by Mifiel, and I'm confirming that in other case studies on Liquid.

For these types of financial assets with actual use cases for blockchains, the market lacks organization around a central depository. Trades are typically over-the-counter (OTC). At times, numerous decentralized depository institutions exist that may need more mutual trust. While they could potentially establish centralized databases with one another or agree on a standard for asset exchange, these would be massive undertakings. This is largely due to the complexity of coordinating relationships with a vast multitude of distinct companies.

A common argument (I once believed this too) for some time is that, on these occasions, the different players could coordinate themselves and build a more efficient central database—making the need for a blockchain irrelevant. This is a fair point, but it is frequently the case that the cost of coordinating so many players across jurisdictions is out of reach. There are, therefore only two options forward:

- A law mandating everyone to coordinate around a central database controlled by a single, highly regulated party (to reduce costs).

- A blockchain.

A blockchain can effectively solve this problem if it's leveraged to track and transfer these assets. Mifiel has resolved this precise problem with promissory notes and is being tackled by other Liquid members with other financial assets as I write (soon to be announced). A blockchain like Liquid can solve these kinds of challenges, as demonstrated by several use cases we're currently examining.

My current understanding is that these situations mainly occur within shadow banking, representing our present system's less-regulated fringe.

Once you establish a handful of these new assets, liquidity, custodians, and exchanges begin to materialize, and it becomes increasingly viable to incorporate all other Liquid assets, but not earlier than that, at least not on a large scale.

Even if you focus on small issuances where the need for liquidity is smaller, an additional problem arises: there are currently no economies of scale when factoring in the legal legwork and fees required. For example, I recently talked to a person working for a bank that told me they had made a small corporate bond issuance and it turns out, the legal fees alone were 20% of the market cap of the overall issuance!!

For these kinds of issuances to materialize, a lot of standardization is still needed regarding legal requirements. Otherwise, it's clear to me that the economics won't work.

Banks Can Do it Overnight

Banks, of course, don't have the problem of liquidity. They own it. They can simply sit down with each other and decide overnight to start issuing on blockchain X and then bring all the liquidity themselves. For that to happen, they need to do rigorous due diligence on the tech stack behind that particular blockchain, which is very timidly starting to happen.

All those proofs-of-concept that have happened throughout the years have helped those truly active in the space to identify several problems and are now searching for a solution. And I say of those truly active because, in my opinion, very few people have done the proper homework to technically figure out where it can make sense to build all this and where not to.

It’s clear from the talks and conferences that I have attended that these are the most pressing issues that banks have encountered when experimenting with blockchain:

- Interoperability: An issue when using private blockchains; otherwise, each chain can become a liquidity silo.

- Lack of confidentiality: Without confidentiality you can’t prevent front-running, and financial players want the same level of privacy that the legacy system guarantees.

- Settlement tokens: If banks are going to use an identical blockchain, they frequently don't want to use each other's tokens for settlement or fee payments, and they want to use each of their own on the same chain.

- Delivery vs payment: Some bankers have told me privately that tokenized deposits are the most likely future for delivery vs payments mechanism, not CBDCs. Some even believe that CBDCs will not be scalable, while others think it will be CBDCs and are convinced about it.

- EVM compatibility: Some small companies in the industry mention EVM compatibility as an issue, but again, banks couldn't care less, and who owns the liquidity is who rules.

- Smart contract formal verification: Interestingly, some players have said EVM is a dead end for public blockchains, as its compatibility with enabling confidentiality is negligible. Also, EVM is problematic for high-value applications as you can't mathematically verify a smart contract is bug-free.

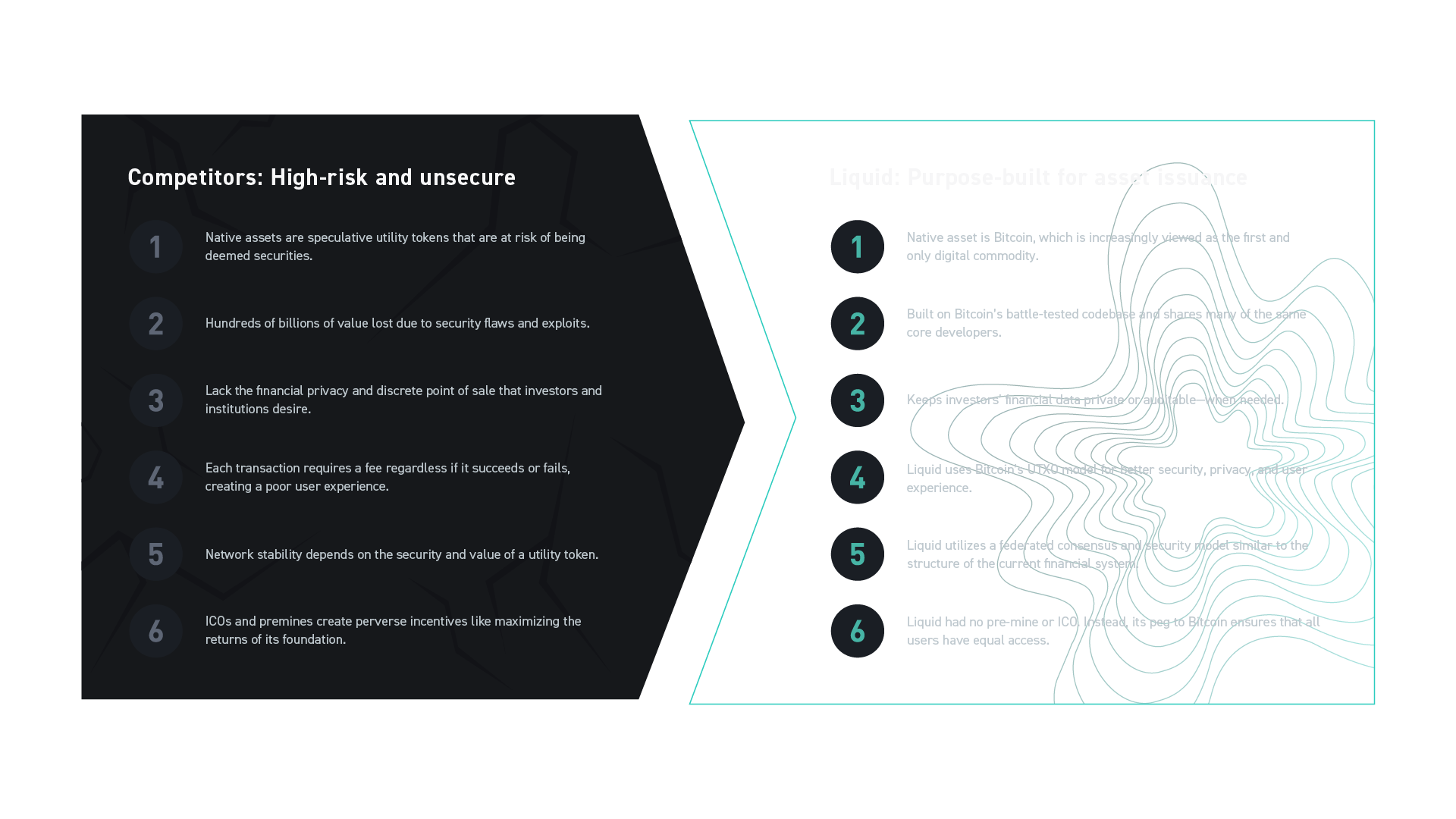

- Bitcoin allergy: In general, banks are highly allergic to Bitcoin. But they are not allergic to businesses built with scammy tokenomics, and hearing their rationale is interesting (perhaps the subject of another post).

- Relationship building: Banks' attention span is short, and sometimes to talk to them, you need to reach out to consultants they have a great relationship with.

- Trusted validators: Banks are very reluctant to participate in blockchains with validators they don't trust.

Technical and Security Concerns

Banks have voiced numerous concerns about blockchains, particularly around issues of privacy, security, and technical limitations. I want to highlight one specific concern that further distinguishes Liquid from other competing chains, like Ethereum: the use of an Unspent Transaction Output (UTXO)-based model versus an account model. This distinction has been validated and reinforced through conversations with the senior technical teams of tier-1 banks:

- The UTXO model enables the trade of multiple assets in a single atomic transaction.

- Some banking chains haven’t figured out how to enable nodes to sign transactions without exposing the keys to the network.

- In an account-based model, the transaction validity depends on the moment of evaluation. Consequently, invalid transactions can be confirmed despite having failed. As an example, in March alone, up to ~2.7% of ETH transactions failed (0.9M of them).

- Transaction validity cannot be cached in account-based model chains since it may change.

- In UTXO models, the child/parent relationship creates a well-defined offline transaction ordering, which can be batched and submitted to the network with predictable results. This means that UXTO model-based chains are capable of using Lightning Network style payment channels, enabling significant increases in transaction throughput.

- Ethereum-based chains do not support native multisig; every transaction originates from a single account with a single signing key associated with it. This means that to effect multisig-like policies, you must create a smart contract that holds coins in escrow and accumulates multiple approvals before releasing them. This is hard to reason about and extremely fragile. (parity multisig hack worth $30m).

Even if the bank were to address some of the issues above, they must adhere to financial regulations, which still need to be clarified, and why, to date, they have only engaged with blockchains in highly controlled, sandboxed environments. This has been evident in numerous use cases they've explored as proofs-of-concept and pilot projects. Many of them have yet to have significant traction, with most being one-off issuances with private placements.

Note, while banks do interact with promissory notes on Liquid, it's not a direct engagement but rather through a loan servicer based in Mexico, necessitating a relatively complex legal framework.

Regulatory Clarity Paves the Way

For banks to make a substantial shift, they need clear regulatory guidelines. This is only beginning to materialize in certain Asian countries, Switzerland, Germany, and to a lesser degree in the European Union, with the upcoming MiCA regulation and the so-called DLT Pilot Regime for securities. And, of course, in smaller jurisdictions such as Seychelles, El Salvador, Andorra, and Gibraltar. Additionally, it will be interesting to follow Rishi Sunak’s push to attract the Crypto industry in the UK or the upcoming McHenry Thompson draft bill in the US Congress.

Most banks are still lagging behind in understanding all these technical behaviors and try to be "smart followers." Still, there are some who are extremely active in the space that are starting to be aware, and that's why the time to choose the right tech stack (blockchain) is more important than ever.

If you would like to further explore the topic of blockchain, we encourage you to join the Capital Markets forum in the Liquid community. There, financial experts and service providers discuss the latest industry trends, developments in capital markets, and the evolving regulatory and legal landscapes.