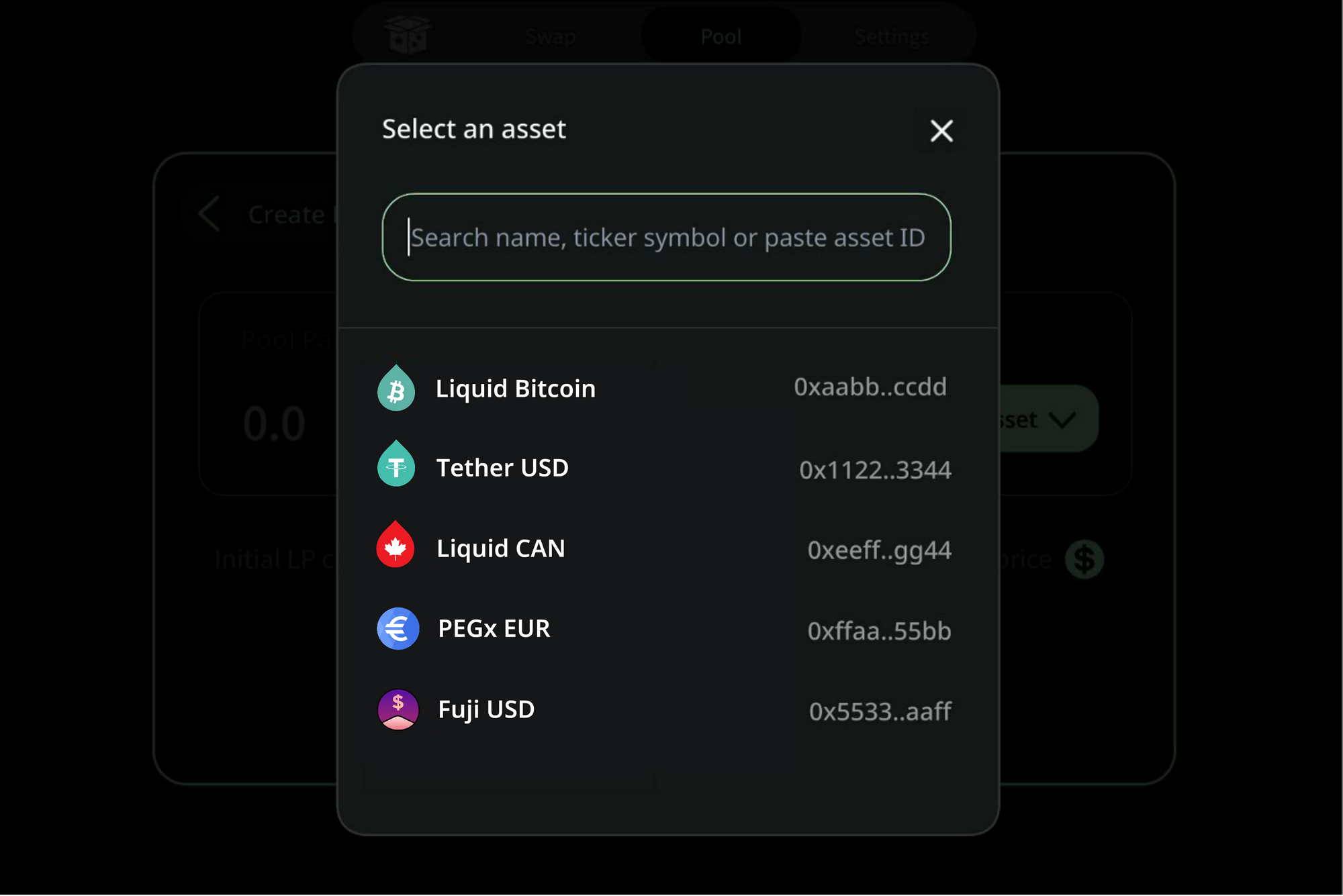

Bitmatrix is an automated market maker (AMM) built on Liquid, which utilizes the power of Bitcoin opcodes to enable trustless liquidity provision across Liquid Bitcoin (L-BTC) and other Liquid-based assets like stablecoins. With a few clicks, users can create their own liquidity pools, add liquidity to other pools, or swap Liquid assets using Bitmatrix’s sleek web interface.

Since our initial announcement of Bitmatrix more than a year ago, the team and I have been hard at work optimizing the platform and squashing bugs thanks to your valuable feedback through our online form. Over that period, we pivoted the covenant design four times, but it was well worth it in the end.

With the release of Bitmatrix’s mainnet beta, we’re confident we have finally found the most optimal design in terms of contract security and byte savings.

New Features and Optimization on Mainnet

One of our many improvements has been contract efficiency, with a 6.75% reduction in vByte consumption, resulting in cheaper fees.

Mainnet beta also comes with a set of new features. Most notably, liquidity pools can now accommodate any asset pair such as USDt<>L-CAD, unlike previous iterations, which limit one of the pairs to L-BTC.

Mainnet beta enables pool deployment with custom LP fee strategies too, giving liquidity providers the ability to create pools using a spectrum of fee tiers. For example, stablecoin to stablecoin pools such as USDt<>FUSD may have lower fees while more volatile pools like USDt<>L-BTC tend to have a higher fee tier. The default fee tier is set to 0.25% for now, although it can be adjusted to as high as 1% or as low as 0.01%. Note LP fee tiers are immutable, and thus cannot be modified once a pool is deployed.

With the mainnet beta, concurrency has also been bumped from 8 to 32 slots. This means each liquidity pool can handle 32 trades per minute. We’re working on scaling concurrency even further and if you’re interested in learning more about how it works read through the design paper.

Give Us Feedback!

We look forward to gathering your feedback on Bitmatrix's latest iteration and continuing to make improvements. Make sure to join us on the Bitmatrix Telegram or shoot us a message on Twitter.

Looking ahead, we have plans to roll out an even more optimized version with the integration of smart contracting language Simplicity in Q4 2023. We expect Simplicity to significantly reduce transaction size and cost as Simplicity programs are highly compact and self-extensible.

We also want to thank the Bitcoin and Liquid community for their continued support, and we hope Bitmatrix enables some new meaningful use cases and brings more user adoption.